tax loss harvesting canada

It offers a tremendous amount of flexibility. Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss.

Tax Loss Harvesting At Work A Wealthsimple Case Study Boomer Echo

Connect With a Fidelity Advisor Today.

. The IRS wash sale rule in the US. According to a study from researchers at MIT between 1926 and 2018 tax-loss harvesting added a little under 1 percent to your returns on average. What is tax loss harvesting Canada.

Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere. You need 50000 to get tax loss harvesting A main benefit of robo-advisors is their tax-loss harvesting abilities. With Charles Schwab Intelligent Portfolios you only get this.

How does tax loss harvesting work. What that means is on a capital gain of 20000 for example. Married couples filing separately can each deduct 1500 from.

The amount of money that you can save with tax-loss harvesting depends on your tax bracket. 2 using the capital loss to offset capital gains on other sales. Here are a few things to keep in mind when harvesting tax losses in taxable accounts.

You can use current capital losses to offset capital gains in the current tax year. Connect With a Fidelity Advisor Today. The funds are then.

Tax-loss harvesting should be done with due care and in a legal. Why tax-loss harvesting is different this year This is the first year in a long time where fixed income assets are delivering negative returns. Canadian aggregate bonds for.

You can then use these losses to. 1 selling securities that have lost value. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada.

The tax does not magically go away. Investors can harvest tax losses by selling their investments for a loss to avoid paying capital gains taxes. Tax-loss harvesting involves using realized losses on some investments to offset capital gains on others within an investors taxable accounts.

Moreover if you have more. Tax-loss harvesting is the timely selling of securities at a loss in order to offset the amount of capital gains tax due on the sale of other securities at a profit. In Canada 50 of capital gains are.

You are saving tax immediately by applying the losses to this year to cancel capital gains or to previous years. Its a strategy thats applicable only on taxable investment. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Dont procrastinate First dont wait until the very end of the year to sell your stock. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada. Tax-loss selling also known as tax-loss harvesting is a technique for realizing or crystallizing capital losses in your non-registered accounts so they can be used to offset.

Tax-loss harvesting also referred to as tax-loss selling can be used by investors with non-registered investments stocks bonds mutual funds and ETFs that are trading below their. WRITTEN BY THE INSPIRED INVESTOR TEAM PUBLISHED ON DECEMBER 18 2020. Tax loss harvesting is a method of reducing your taxes on capital gains realized from the sale of certain investments.

If you have losses of 100000 and gains of 100000 you can report your total investment income as 0 meaning you owe no capital gains tax. The three steps in the tax-loss harvesting process are. If the amount of losses exceeds.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Tax loss harvesting is a tax deferral strategy. These gains arose due to.

This maneuver is known as tax-loss harvesting or tax loss selling. Tax-loss selling also known as tax-loss harvesting is a strategy used to reduce taxes on capital gains incurred from the sale of an asset. After the sale is complete you will need to report the loss on your tax return.

Single filers and married couples filing jointly can deduct up to 3000 in realized losses from ordinary income. Details a specific time period and action when it is against the law to make use of crypto tax-loss harvesting to offset capital gains with capital. In Canada the income inclusion rate for capital gains is 50 percent which then gets taxed at an individuals marginal tax rate.

Tax-loss selling also known as tax-loss harvesting is a strategy available to investors.

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

What Is Tax Loss Harvesting Ticker Tape

Turning Losses Into Tax Advantages

What Is Tax Loss Harvesting Ticker Tape

2022 Crypto Tax Loss Harvesting Guide Cointracker

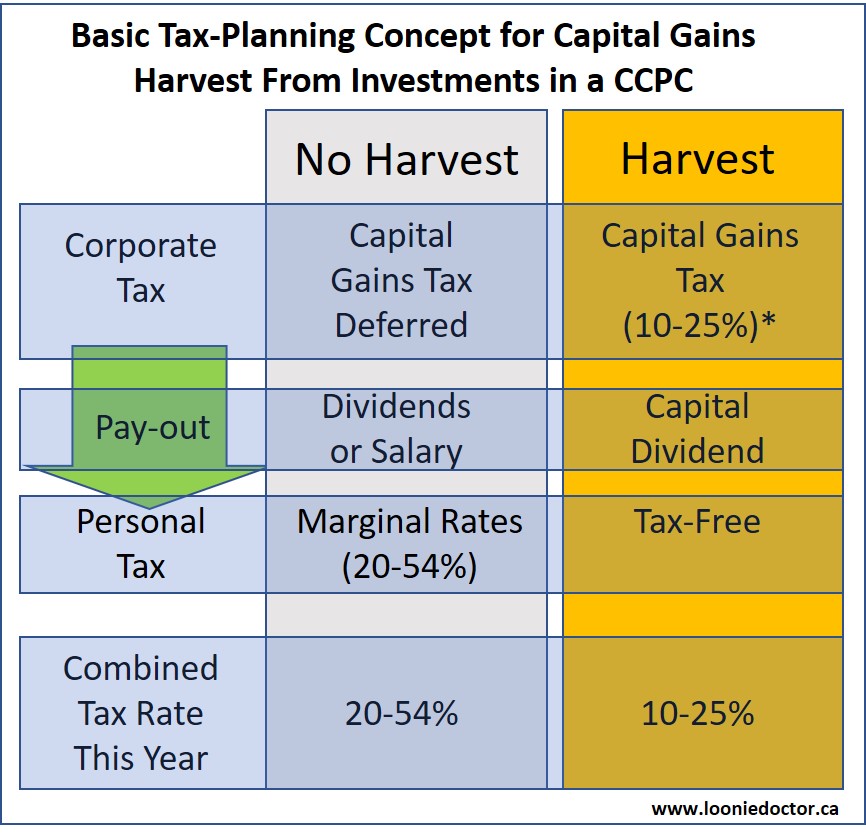

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

How To Use Tax Loss Harvesting To Boost Your Portfolio

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

How To Use Tax Loss Harvesting To Boost Your Portfolio

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management